IEA World Energy Outlook 2025 Shows the Key Shifts Shaping Elcogen’s Market

Global energy is shifting at full throttle and the IEA’s World Energy Outlook 2025 makes that crystal clear. Geopolitical risks, system vulnerabilities, and weather extremes are rocking markets, but so are growth opportunities for clean tech, innovation, and low-carbon fuels. Here’s what really stood out to us and why Elcogen is primed to win in this new energy order.

1. The Main Drivers | Demand, Dynamics & Risk

Emerging economies are powering demand. Growth is increasingly coming from India, Southeast Asia, Latin America, the Middle East, and Africa. The geography is shifting whereby 80% of demand growth is projected in high-solar regions.

LNG buildup poses a risk ahead. A staggering 300 billion cubic metres of new LNG export capacity is scheduled by 2030. But the IEA warns that demand may not keep up. Overhangs could force capacity under-utilisation (falling to 75% by 2030 and 50% by 2035 in one scenario) potentially forcing some plants to shut down or convert to hydrogen-based fuels such as ammonia or methanol.

Coal’s fate is Asia’s call. Coal demand is still driven by a handful of economies (China, India, Southeast Asia), making the future of coal deeply tied to policy and grid integration in those regions.

2. There are Multiple Potential Futures, One Truth. Flexibility Wins.

As alluded to above, the IEA lays out a few very different potential energy paths from fossil-fuel persistence to a net-zero pivot. In one scenario, oil and gas grow through 2050. In another, coal declines earlier, oil flattens, but gas keeps rising under supportive policies. In a third ambitious tech scenario, fossil fuels shrink across the board, replaced by renewables, nuclear, and hydrogen. And yes, nuclear is back. In addition to reactors that are restarting operation, notably in Japan, there are more than 70 GW of new capacity under construction, one of the highest levels in 30 years. These include Small Modular Reactors (SMRs). Hydrogen, especially green hydrogen, features heavily across all scenarios as a backbone for low-carbon, flexible systems.

3. Welcome to the “Age of Electricity”

Electricity is now central. Under multiple outlooks, demand rises by ~ 40% by 2035. Why? Because of cooling (thanks, rising temperatures), data centers & AI, electric transport, heat pumps, and more. More electric power doesn’t simply mean renewables. Reliable storage and flexibility matter. Solar and wind are growing, but without storage and adaptable infrastructure, variability will bite.

In industry, some high-temperature processes are hard to electrify directly. This points to a growing role for electrolytic hydrogen, states the IEA. And in transport sectors like shipping and aviation, battery limits make hydrogen-based fuels more attractive. Hydrogen production via electrolysis is expected to add around 400 TWh to total electricity demand by 2035, representing about 1.5% of current global electricity demand.

4. Renewables Are Surging. But So Is Risk.

Solar PV leads the pack with record deployments globally. China remains the dominant market, accounting for 45–60 % of global deployment over the next ten years. The rapid expansion of renewables, batteries, and other low-emissions technologies is heavily dependent on minerals and rare earths. But supply chains are fragile. Key materials like lithium, cobalt, nickel, and rare earths remain highly concentrated. Again, China accounts for an average of 70% of global refining capacity across 19 of the 20 minerals assessed by the IEA. That concentration raises strategic risk but opens the door to technologies that rely less on rare materials.

5. The Levers Are There… If We Pull Them.

The IEA says climate change mitigation efforts are slowing but big emissions cuts are possible with existing tech. These are the levers:

- Scale up wind, solar, nuclear, geothermal

- Boost energy efficiency across appliances, buildings, industry

- Cut methane from fossil operations

- Electrify transport, heating, industrial end-uses

- Deploy low-emissions hydrogen / sustainable fuels where electrification doesn’t cut it

- Use carbon capture where needed

In one IEA scenario, low-emissions hydrogen and hydrogen-based fuels quadruple by 2035. But the IEA warns that we need strong policy, big investment (especially in developing economies), and smart deployment to make it happen.

6. Green Hydrogen’s Role is Expanding

Hydrogen is no longer a fringe play. It’s core. In 2024, global hydrogen use in the energy sector reached ~100 Mt, with 55% in industry and 45% in refineries, yet less than 1% of demand was met by low-emissions hydrogen and production still generated ~980 Mt CO₂. But momentum is shifting. Low-emission hydrogen is set to displace a meaningful share of fossil-hydrogen in refining and heavy industry, potentially ~35% in industry and ~30% in refineries by 2035, and to gain ground in shipping, aviation, and even power as it climbs toward 2% of final energy consumption by 2035 and nearly 10% by 2050.

Under the Net Zero Emissions (NZE) Scenario in the World Energy Outlook 2025 report, hydrogen and ammonia fuels are also set for real scale in transport. By 2035, low-emissions ammonia, synthetic methanol, and green hydrogen could meet ~30% of shipping energy needs, while synthetic kerosene begins supplying ~3% of aviation fuel, with rapid growth beyond that. Hydrogen/ammonia fuels could help deliver seasonal storage and flexibility.

Elcogen is bridging the energy transition

Elcogen is very well-aligned with this shifting landscape (no matter which of the IEA’s scenarios play out) in four very tangible ways:

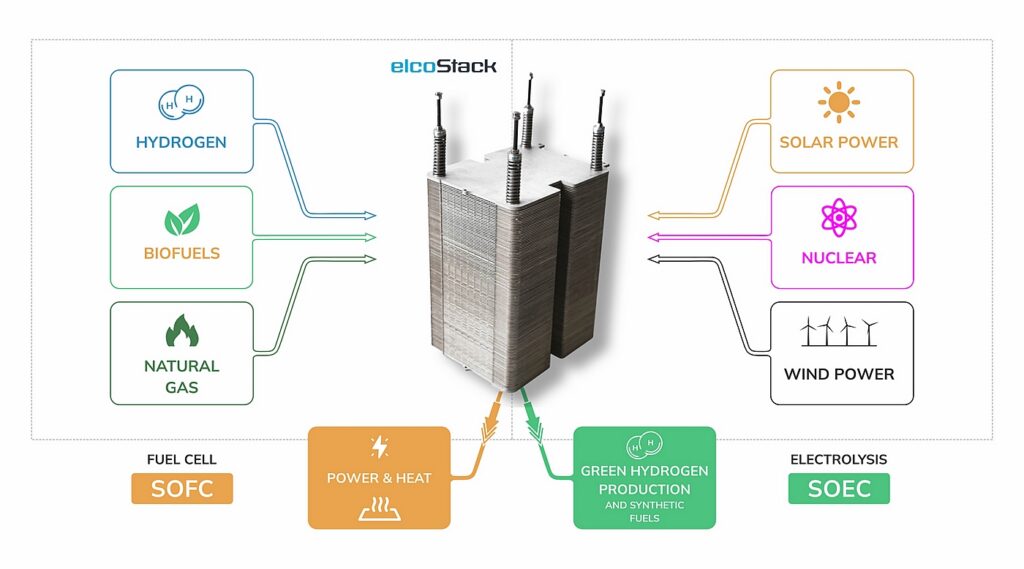

Fuel-agnostic, flexible technology = resilience.

Our SOFC (Solid Oxide Fuel Cell) components run on diverse fuels, whether natural gas, biogas, LNG, or hydrogen. That makes them highly adaptable for markets undergoing rapid change.

With Elcogen, mineral risk is hedged.

Our products rely on fewer critical materials (unlike PEM that requires iridium and platinum), reducing exposure to volatile or concentrated mineral supply chains.

Energy sovereignty reigns.

In regions that are net importers of fuel, our tech supports local, reliable, clean power supply, helping reduce dependence on external supply.

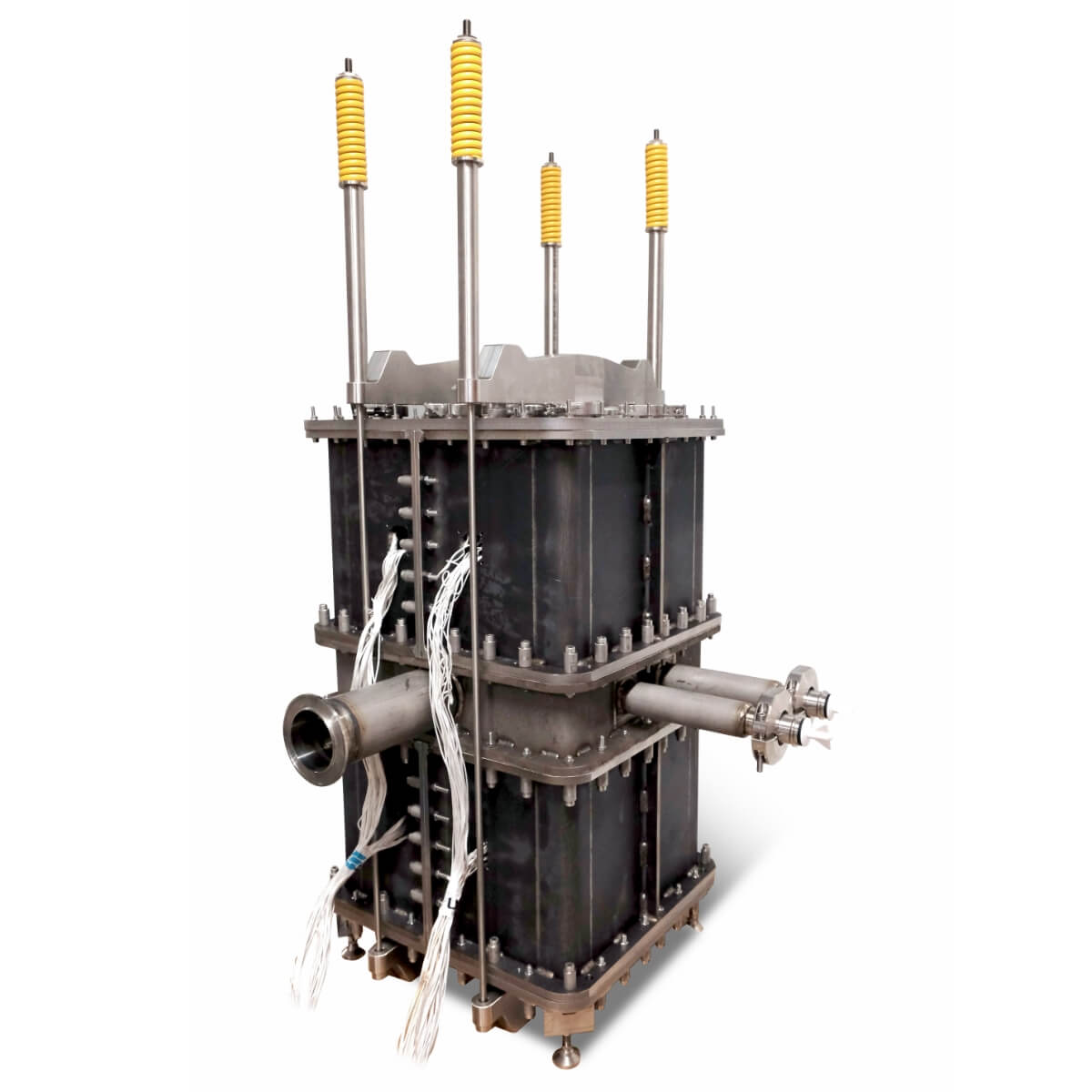

Hydrogen integration will happen.

Pairing renewables with SOECs (Solid Oxide Electrolyser Cells) for green hydrogen production and SOFCs for power is an efficient low-carbon strategy. Cheap surplus renewable electricity produces hydrogen via SOECs; during high-price or peak-demand periods, that stored hydrogen runs through SOFCs to generate clean power. The result is a high-efficiency, zero-carbon energy-arbitrage cycle that absorbs excess renewables and delivers electricity when it’s most valuable.

The Bottom Line

In a world of rising electricity demand, shifting geopolitics, and uncertainty over fuel markets, the winners will be those who can adapt. And that’s exactly where Elcogen sits. We’re all about bridging the energy transition. If you want to know more – get in touch!

Text: Laura Quinton